A strong credit score unlocks a world of financial benefits – better loan rates, lower insurance premiums, and even easier access to apartments and utilities. But what if your score needs a serious boost? Can you really raise your credit score by 200 points?

This article talks about the strategies for improving your credit score, explores the possibility of a 200-point jump, and outlines realistic timelines for credit score improvement.

Raising Your Credit Score 200 Points in 30 Days: Fact or Fiction?

Let’s be upfront: significantly raising your credit score in 30 days is unlikely. FICO scores, the most common credit scoring model, consider several factors over time, and positive changes typically take months to reflect.

However, there are steps you can take immediately to see a small improvement within 30 days. These include:

- Dispute errors on your credit report: Inaccurate information can bring your score down. Reviewing your credit report for errors and disputing them with the credit bureau can lead to a quick increase if the errors are corrected.

- Make a significant debt payment: If you have a high credit card balance, a large one-time payment can reduce your credit utilization ratio (the amount of credit you’re using compared to your limit), which can have a positive impact.

It’s important to remember that these are small steps, and significant score improvement takes a sustained effort.

How Long Does it Take to Raise Your Credit Score 200 Points?

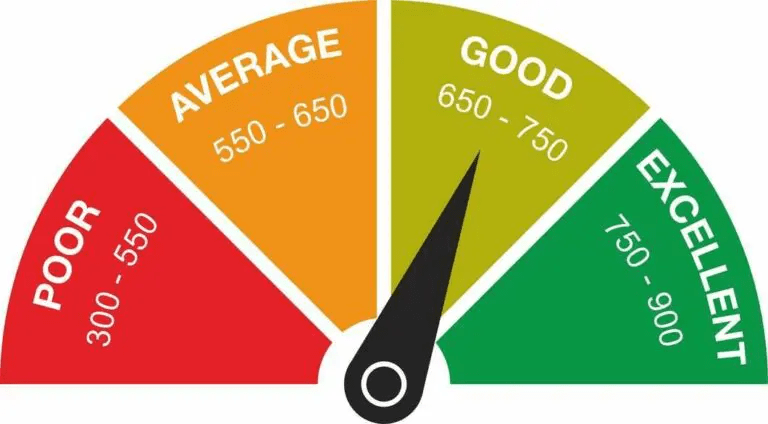

The timeframe for a 200-point increase depends on your starting point and credit habits. Here’s a general breakdown:

- Severely damaged credit (below 620): Rebuilding credit can take 24 months or more. Consistent on-time payments, reduced credit utilization, and addressing negative marks are crucial.

- Fair credit (620-670): Significant improvement is possible within 12-18 months with consistent positive credit management.

- Good credit (670-740): A 200-point jump might be achievable in 6-12 months with focused efforts on improving specific factors like credit utilization.

- Excellent credit (740+): Maintaining a high score is essential. Focus on keeping credit utilization low and avoiding new inquiries.

These are just estimates. Individual results will vary.

Can My Credit Score Go Up 200 Points in a Month?

Technically, yes, a 200-point increase in a month is possible, but it’s highly unlikely for most people. Here’s why:

- FICO scores consider multiple factors: Payment history (35%), credit utilization (30%), credit age (15%), credit mix (10%), and new credit inquiries (10%) all contribute to your score. A single action might not significantly impact all these factors.

- Negative marks stay on your report for years: Late payments, collections, and bankruptcies can have a long-lasting negative effect, making a rapid 200-point jump challenging.

While a 200-point increase in 30 days might be unrealistic, focusing on long-term strategies can significantly improve your score over time.

Strategies to Raise Your Credit Score

Here are some key strategies to raise your credit score:

- Make on-time payments consistently: This is the single most important factor in your credit score. Set up autopay or calendar reminders to avoid late payments.

- Reduce your credit card balances: Aim for a credit utilization ratio below 30%. Paying down debt can significantly improve your score.

- Don’t close old credit accounts: A long credit history with responsible management can positively impact your score.

- Consider a credit builder loan: These specialized loans can help establish or rebuild credit.

- Dispute errors on your credit report: Regularly review your credit report and dispute any inaccurate information.

While a 200-point jump in 30 days might be a fantasy, consistent positive credit management can significantly improve your score over time. Focus on the strategies mentioned above, and be patient. With dedication, you can unlock the financial benefits that come with a strong credit score.

How Quickly can I Raise My Credit Score 200 Points?

If you’re looking for guidance on your credit score journey, Polosploits can be a valuable resource. They specialize in credit score repair, a process designed to help improve your credit health. This can involve several steps, including helping you identify and dispute any errors on your credit report. Inaccurate information can bring your score down, and Polosploits can assist you in challenging these mistakes with the credit bureaus.

They can also provide guidance on managing your credit utilization ratio, which is the amount of credit you’re using compared to your limit. By keeping this ratio low, you can demonstrate responsible credit management to creditors and improve your score. Polosploits may also offer advice on building a positive credit history, which can involve strategies like making on-time payments and strategically using credit cards.

It’s important to remember that credit repair is a journey, not a quick fix. However, with Polosploits’ help and your own dedication to responsible credit management, you can make significant strides towards a healthier credit score and unlock the financial benefits that come with it.

One comment

[…] guidance on your credit score journey, Polosploits can be a valuable resource. They specialize in credit score repair, a process designed to help improve your credit health. This can involve several steps, […]

Comments are closed.