The appeal of a higher credit score can be overwhelming. It promises easier access to loans, lower interest rates, and financial freedom. In the quest for a better financial standing, many people consider hiring a hacker to boost credit score. But is it worth the risk? Let’s go into the world of credit score boosting services.

Who is a Credit Score Hacker?

A credit score hacker is not someone who breaks into a credit bureau’s system. Instead, it’s a term often used to describe individuals or companies that promise to rapidly improve credit scores through questionable methods. These individuals often employ tactics that violate fair credit reporting laws.

Common tactics used by credit score hackers include:

- Identity theft: Using someone else’s personal information to establish new credit accounts.

- Fake reporting: Submitting false information to credit bureaus to artificially inflate credit scores.

- Pay-for-delete schemes: Promising to remove negative items from credit reports in exchange for payment.

- Credit repair: Charging upfront fees for services.

Rapid Credit Boosters

The promise of rapid credit score improvement is tempting, but it’s often a mirage. Legitimate credit building takes time and responsible financial behavior. Any service claiming to dramatically boost your credit score in a short period is likely a scam.

Beware of these red flags:

- Guarantees: No legitimate credit repair service can guarantee specific results.

- Upfront fees: Reputable credit repair companies typically charge fees based on results.

- High-pressure sales tactics: Be wary of services that pressure you into signing up immediately.

Best App to Improve Credit Score

Instead of looking for shortcuts, focus on building your credit score through some other means. There are several reputable apps and tools that can help you monitor your credit, understand your score, and make informed financial decisions.

Here are some legitimate options:

- Credit monitoring services: These services track your credit report for changes and alert you about potential issues.

- Budgeting apps: By helping you manage your finances effectively, you can improve your credit utilization ratio, a key factor in credit scores.

- Debt management apps: These apps can help you create a plan to pay off debt, which can positively impact your credit score.

Building a strong credit score takes time and discipline. Avoid falling prey to quick fixes. Instead, focus on responsible financial habits and using legitimate tools to improve your credit health.

Understanding Your Credit Score and Its Components

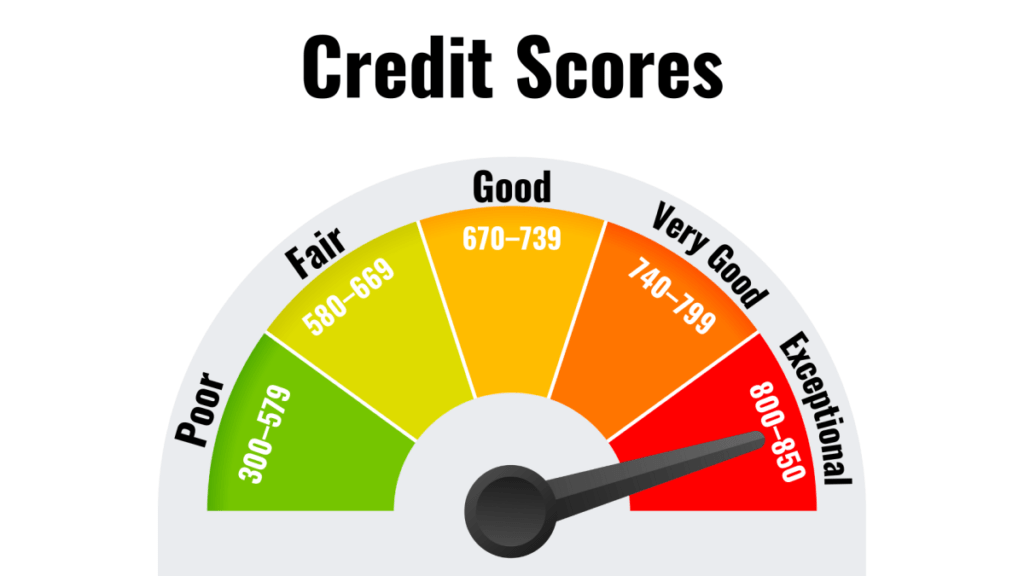

Before going deeper into credit improvement strategies, it’s important to understand what constitutes a credit score. Credit scores are numerical representations of your creditworthiness, calculated based on information in your credit report.

Key factors influencing your credit score include:

- Payment history: This is the most significant factor, accounting for 35% of your score. Consistent on-time payments demonstrate financial responsibility.

- Credit utilization: This measures the amount of credit you’re using compared to your available credit. A lower credit utilization ratio generally results in a better score.

- Credit history length: The longer your credit history, the better. It shows a track record of responsible credit management.

- Credit mix: Having a variety of credit accounts (credit cards, loans, etc.) demonstrates credit diversity.

- New credit: Frequent applications for new credit can negatively impact your score.

Legitimate Ways to Improve Your Credit Score

While the temptation for quick fixes is strong, building a solid credit score requires patience and responsible financial habits. Here are legitimate strategies to enhance your creditworthiness:

- Consistent on-time payments: Make all payments on time, every time. Set up automatic payments if needed.

- Reduce credit card balances: Aim to keep credit utilization below 30% for optimal results.

- Limit new credit applications: Avoid applying for multiple credit cards or loans simultaneously.

- Dispute errors: Review your credit report regularly and dispute any inaccuracies.

- Become an authorized user: This can help build credit history, but choose responsibly.

- Consider a secured credit card: This can be a good option for those with limited credit history.

- Utilize credit counseling: If you’re struggling with debt, credit counseling can provide guidance.

The Role of Credit Repair Companies

Credit repair companies can be helpful for individuals with complex credit issues, such as identity theft or multiple collection accounts. However, it’s essential to choose a reputable company and understand their services.

When considering a credit repair company, ask:

- How do they charge for their services?

- What specific services do they offer?

- What is their success rate?

- Are they accredited by any professional organizations?

Polosploits is a service dedicated to assisting individuals in improving their credit scores. By offering expert guidance and support, Polosploits aims to empower people to overcome credit challenges and achieve their financial goals. Their services are designed to help clients understand their credit reports, dispute inaccuracies, and develop effective strategies for credit score enhancement.

Protecting Yourself from Credit Score Scams

To safeguard yourself from credit score scams, follow these tips:

- Be wary of promises of rapid credit improvement.

- Avoid upfront fees for credit repair services.

- Research companies thoroughly before engaging their services.

- Monitor your credit report regularly for suspicious activity.

- Educate yourself about credit and credit scores.

Building a strong credit score is a journey, not a destination. Consistent financial responsibility is the key to achieving and maintaining good credit.

3 Comments

[…] can be a viable option for those with limited credit history who plan to make consistent purchases from their store and prioritize on-time payments. However, […]

[…] be upfront: significantly raising your credit score in 30 days is unlikely. FICO scores, the most common credit scoring model, consider several factors […]

[…] Credit Monitoring: Credit Karma provides free access to your TransUnion and Equifax credit reports, allowing you to track your credit score, identify errors, and monitor for suspicious […]

Comments are closed.