MyFICO.com is a prominent player in the credit score arena, but is it the be-all and end-all for monitoring your financial health? This articles dives deep into MyFICO’s legitimacy, exploring its features, security, and value proposition to help you make an informed decision.

MyFICO.com Reviews

MyFICO boasts the official status of being the consumer division of Fair Isaac Corporation (FICO), the originator of the widely-used FICO credit score. This association lends credibility, but user reviews paint a more nuanced picture.

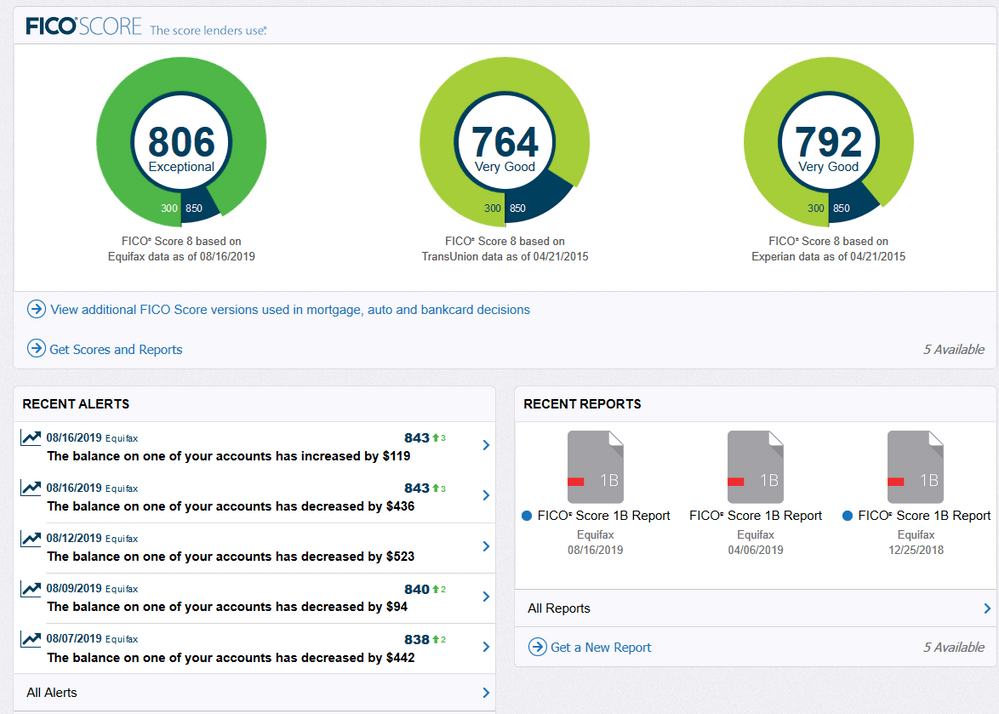

Positive reviews highlight MyFICO’s ease of use and the convenience of accessing FICO scores from all three major credit bureaus (Equifax, Experian, and TransUnion) in one place. However, negativity often centers around cost. While a free tier exists, it offers limited features. Paid plans can be expensive, and some users question whether the extra features justify the price tag.

MyFICO Credit Score: Accessing the Real Deal

One undeniable advantage of MyFICO is access to your actual FICO scores, the very ones lenders use for important decisions like loan approvals and interest rates. Unlike generic credit scores offered elsewhere, these scores hold significant weight. MyFICO provides various score versions tailored to specific loan types like mortgages or auto loans, allowing you to target your credit improvement efforts effectively.

However, it’s important to remember that FICO scores are just one piece of the credit puzzle. Lenders employ other factors in their evaluations as well.

Is MyFICO Safe?

Security is paramount when dealing with sensitive financial information. MyFICO employs industry-standard security measures like encryption and multi-factor authentication to safeguard your data. However, some users express concern about the lack of identity theft protection features beyond basic monitoring.

For robust identity theft protection, it might not be the sole solution. Consider combining it with services that offer proactive monitoring and identity restoration assistance.

Is MyFICO Worth It? Weighing the Pros and Cons

The value proposition of MyFICO hinges on your specific needs. Here’s a breakdown:

- Pros: Access to genuine FICO scores, detailed credit reports, score simulations for future planning, educational resources.

- Cons: Costly paid plans, limited identity theft protection, some features might be replicated by free credit monitoring services.

For casual credit monitoring, free alternatives might suffice. But if you’re serious about optimizing your credit score for significant financial goals like buying a house, the service in-depth FICO score access and educational tools might be worth the investment.

How Often Does MyFICO Update?

MyFICO itself doesn’t directly influence your credit score updates. The credit bureaus (Equifax, Experian, and TransUnion) hold the key. They typically update your credit report with new information every 30-45 days, but the frequency can vary depending on the creditor. The service retrieves your information from these bureaus, so you’ll see updates reflected on the platform within that timeframe.

Pro tip: It’s wise to obtain free credit reports directly from each bureau annually for a more comprehensive picture.

Is MyFICO Score Accurate?

The service prides itself on providing accurate FICO scores directly from the source. However, discrepancies can arise. Here’s why:

- Reporting errors: Inaccuracies might exist in your credit reports. You can dispute these errors with the credit bureaus to rectify them.

- Scoring model variations: Lenders might use slightly different FICO score versions than those offered by MyFICO.

While MyFICO scores are highly reliable, it’s always a good practice to maintain vigilance and check the accuracy of your credit reports across all three bureaus.

Polosploits is a reputable service that help users improve their credit scores. This can be a valuable service, especially for those struggling with financial difficulties or inaccuracies on their credit reports. Consider a reputable credit repair service like Polosploits to help you navigate the complexities of credit score improvement. Polosploits offers a hassle-free approach to identifying and disputing errors on your credit report, an important step in maximizing your score.

MyFICO – A Legitimate Tool with Caveats

MyFICO is a legitimate platform for accessing your FICO scores and credit reports. Its association with FICO and comprehensive score offerings are valuable assets. However, consider these points before subscribing:

- Cost: Paid plans can be expensive. Evaluate your needs and compare with free alternatives.

- Identity Theft Protection: It offers limited protection. Consider supplementing it with a robust identity theft protection service.

- Alternatives: Explore free credit monitoring services for basic needs.

MyFICO can be a valuable tool in your financial toolkit, but a well-rounded approach that considers cost, security, and alternative options is key to maximizing its effectiveness. By understanding its strengths and limitations, you can make an informed decision about whether the service is the right fit for your credit monitoring journey.

Leveraging MyFICO Effectively

If you decide the service aligns with your credit monitoring needs, here are some tips to maximize its benefits:

- Choose the right plan: It offers multiple tiers with varying features. Opt for the plan that best suits your goals. If in-depth credit analysis and educational resources are priorities, a premium plan might be justified.

- Set credit score goals: The score simulations can be a powerful tool. Set realistic goals based on your creditworthiness and utilize MyFICO’s resources to develop a personalized credit improvement plan.

- Maintain vigilance: Don’t rely solely on the service. Regularly review your credit reports directly from each bureau to ensure accuracy and identify any discrepancies promptly.

- Practice good credit habits: It is a valuable tool, but it’s not a magic bullet. Building good credit habits like on-time payments, low credit utilization, and a diversified credit mix are crucial for long-term credit health.

MyFICO is a legitimate platform with a strong reputation. By understanding its strengths and limitations, you can leverage it effectively to gain valuable insights into your credit health. Remember, MyFICO is a tool, and like any tool, its effectiveness depends on how you use it.

For a well-rounded credit monitoring strategy, consider combining the service with free credit monitoring services and regular reviews of your credit reports directly from the bureaus.