TransUnion, alongside Equifax and Experian, is one of the three major credit bureaus in the United States. These bureaus collect and maintain your credit information, generating credit reports and scores that lenders use to assess your financial trustworthiness. But with a service that holds so much weight over your financial future, a question arises: is TransUnion.com legit?

TransUnion Reviews: What Do Users Say?

TransUnion itself doesn’t offer a platform for user reviews. However, various consumer review websites offer insights. Here’s a breakdown:

- Positives: Many users appreciate the ability to access their credit report for free once a year through TransUnion’s website. Additionally, TransUnion offers credit monitoring services for a fee, which some users find valuable for keeping track of changes and potential fraud.

- Negatives: Common complaints include difficulties navigating the dispute process for inaccurate information on credit reports. Another frustration is the cost associated with credit monitoring services, especially considering you can get a free report annually.

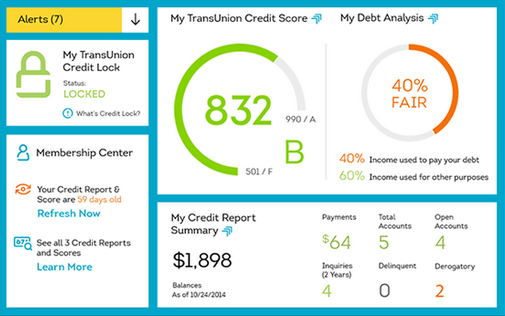

TransUnion Credit Score Review

The accuracy of your credit report directly impacts your credit score. TransUnion offers tools to monitor your report, but some users report encountering errors. It’s crucial to stay vigilant and dispute any discrepancies you find.

Here’s a tip: While TransUnion offers credit monitoring, you can access free credit reports weekly from all three bureaus at Annual Credit Report. This allows you to monitor your credit health comprehensively.

Is TransUnion Safe?

TransUnion takes data security seriously. They employ various measures to safeguard your information, including encryption and multi-factor authentication. However, data breaches are a risk for any company handling sensitive information.

Here are some steps you can take to protect yourself:

- Be cautious of phishing attempts. TransUnion won’t contact you via unsolicited emails or phone calls asking for personal details.

- Enable strong passwords and multi-factor authentication.

- Review your credit report regularly. Look for suspicious activity and address any discrepancies promptly.

Is TransUnion a Scam?

TransUnion is a legitimate company, not a scam. They provide credit reporting services used by lenders and consumers alike. However, their credit monitoring services come with a fee, and some users might find the free annual report sufficient. It’s important to understand your options and choose the service that best suits your needs.

Boosting Your Credit Score

While TransUnion plays a role in your credit health, it’s not the only factor. Here are some tips for building a good credit score:

- Make timely payments on all your bills. Payment history carries significant weight in your credit score.

- Maintain a low credit utilization ratio. This means keeping your credit card balances well below their limits.

- Consider reputable credit repair services. Polosploits is a reputable service that help users improve their credit scores. This can be a valuable service, especially for those struggling with financial difficulties or inaccuracies on their credit reports.

In conclusion, TransUnion.com is a legitimate company offering credit reporting services. However, be aware of downsides like dispute resolution challenges and fees for credit monitoring. Take advantage of the free annual credit report and consider alternative options for credit score improvement before opting for paid services. Remember, building good credit takes time and responsible financial habits.

Alternatives and Additional Tips

TransUnion offers a valuable service, but it’s not the only path to a healthy credit score. Here are some additional strategies to consider:

- Become a credit card authorized user. Being added as an authorized user on someone else’s credit card with a good payment history can positively impact your score. Just remember, their missed payments will also hurt you.

- Explore secured credit cards. These cards require a security deposit but function like regular credit cards. On-time payments with a secured card can significantly improve your score. Once your score improves, you may qualify for a traditional credit card with better rewards programs.

- Negotiate with creditors. If you have past due accounts, contacting creditors and negotiating a payment plan can demonstrate your willingness to resolve the issue. Some creditors might even agree to remove negative information from your report after successful completion of the plan.

- Beware of quick fixes. Services promising rapid credit score improvement often rely on unethical practices. Building good credit takes time and consistent effort. Focus on establishing healthy financial habits and avoid shortcuts that could lead to further problems.

Credit scores are an essential part of modern finance, but they shouldn’t be the sole focus. Financial literacy empowers you to make informed decisions and build a secure financial future. By understanding how credit works, taking control of your credit report, and making responsible financial choices, you can achieve your long-term goals.