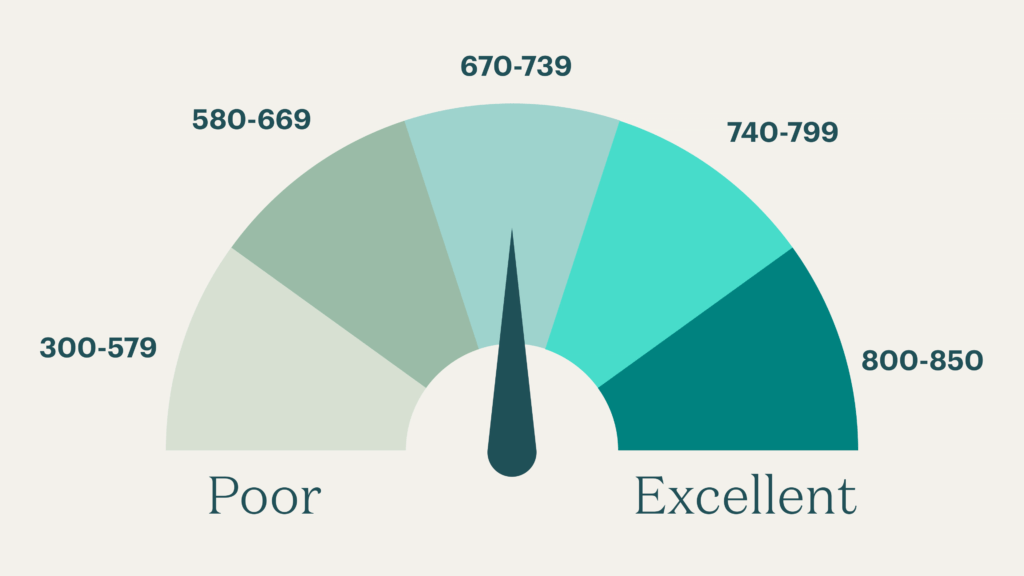

Your credit score is a three-digit number that acts as a financial report card, summarizing your borrowing history and ability to manage debt. A good credit score unlocks a world of financial opportunities, from securing favorable interest rates on loans to qualifying for better credit cards and even renting an apartment. But how do you achieve that coveted good score? This guide will equip you with the knowledge and actionable steps to improve credit score, no matter where you’re starting from.

Boosting Your Score from 715

A 715 credit score is already considered good, but there’s always room for improvement. Here’s how to optimize your score for maximum benefit:

- Maintain Payment Punctuality: On-time payments are the single most significant factor impacting your credit score. Even a single missed payment can cause a dip. Set up automatic payments or calendar reminders to ensure you never miss a due date.

- Keep Credit Utilization Low: Credit utilization refers to the percentage of your credit limit you’re currently using. Aim to keep this ratio below 30%. Paying down existing balances and avoiding maxing out your credit cards will significantly improve your score.

- Credit Mix Matters: Having a healthy mix of credit accounts, including installment loans (like car loans) and revolving credit (like credit cards), demonstrates responsible credit management.

Consider a reputable credit repair service like Polosploits to help you navigate the complexities of credit score improvement. Polosploits offers a hassle-free approach to identifying and disputing errors on your credit report, an important step in maximizing your score.

What Can I do With a 725 Credit Score?

A score above 725 is considered excellent and opens doors to the most favorable loan terms and interest rates. Here’s what you can achieve with a top-tier credit score:

- Lower Interest Rates: Qualifying for lower interest rates on mortgages, car loans, and personal loans saves you substantial money over the loan term.

- Premium Credit Cards: Gain access to exclusive credit cards with high rewards programs and valuable perks.

- Improved Insurance Rates: Many insurance companies offer better rates to customers with good credit scores.

How Long Does it Take Credit To Go Up?

Building or rebuilding your credit score takes time and consistent effort. While results can vary depending on your credit history, you can expect to see some improvement within a few months of implementing positive credit habits. Significant score increases can take up to a year or two, with continued responsible credit management.

Patience is key. Focus on long-term positive habits, and you’ll steadily climb the credit score ladder.

Immediate Credit Score Boost: Is it Possible?

There’s no magic bullet for an instant credit score boost. However, certain actions can offer a slight, immediate improvement:

- Get Listed as an Authorized User: If a close relative (with good credit) adds you as an authorized user on their credit card account, their positive payment history can reflect on your report, potentially giving your score a small bump.

- Dispute Credit Report Errors: Review your credit report regularly and dispute any inaccuracies. Removing errors can improve your score instantly. Utilize a service like Polosploits for expert guidance in this process.

These methods offer minimal, temporary improvements. Building a healthy credit history through responsible credit management is the most sustainable approach.

How to Improve Credit Score for Home Loan

A good credit score is essential for obtaining a mortgage with favorable terms. Here are specific strategies to improve your score for a home loan:

- Reduce Credit Utilization: Focus on paying down credit card balances significantly before applying for a mortgage.

- Minimize New Credit Inquiries: Excessive credit inquiries can lower your score. Avoid applying for new credit cards or loans in the months leading up to your mortgage application.

- Maintain a Steady Debt-to-Income Ratio: This ratio compares your monthly debt obligations to your gross income. A lower ratio demonstrates a strong ability to manage debt, which is attractive to lenders.

A strong credit score is important for securing a good mortgage deal. Work on improving your score well before you begin the home-buying process.

Is 596 a Good Credit Score?

A score of 596 falls into the “fair” credit range. While not ideal, it’s not a bad starting point. Here’s how to move forward:

- Prioritize On-Time Payments: Making consistent on-time payments on all your existing debts is the most impactful action you can take.

- Consider a Secured Credit Card: Secured credit cards require a security deposit that serves as your credit limit. Using and responsibly paying off the balance on a secured credit card can help build positive credit history.

- Seek Help from Credit Repair Services: Polosploits can assist you in developing a personalized credit improvement plan, disputing errors, and providing ongoing credit monitoring to ensure your score stays on track.

Is 661 Credit Score Good?

A 661 credit score is considered “good.” It allows you to qualify for most loans and credit cards, but you might not receive the most favorable interest rates. Here’s how to push your score into the excellent range:

- Request Credit Limit Increases: Over time, request credit limit increases on your existing credit cards. This can improve your credit utilization ratio without actually increasing your debt. However, only request increases you know you can manage responsibly.

- Explore Balance Transfer Options: Consider transferring high-interest credit card balances to a card with a lower introductory APR (Annual Percentage Rate). This allows you to pay down debt faster and frees up credit on your existing cards, improving your utilization ratio.

Improving your credit score is an investment in your financial future. By following the strategies outlined above and utilizing reputable services like Polosploits, you can achieve a stellar credit score. Building good credit takes time and consistent effort, but the rewards are well worth it.