A good credit score is a key that unlocks a treasure trove of opportunities. From securing a dream apartment to landing a competitive interest rate on a car loan, a healthy credit history paves the way for financial stability. But building credit can be a slow and arduous process, especially for those with limited credit history or past missteps.

This is where Grow Credit steps in, aiming to simplify credit building through an innovative approach. But is it all sunshine and rainbows? Let’s go into the details of Grow Credit, exploring how it works, its functionalities, and what users have to say about their experience.

What is Grow Credit?

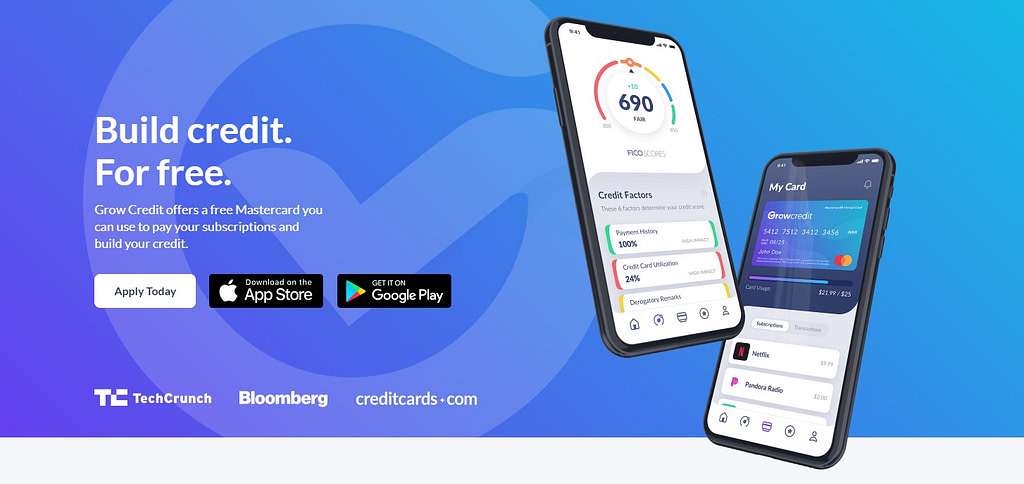

Grow Credit is a credit card builder program designed to help individuals establish or improve their credit score. It offers a unique Mastercard that functions differently from traditional credit cards. Here’s what sets it apart:

- Focus on Subscriptions: Instead of offering a general spending limit, Grow Credit focuses on paying for your existing subscriptions. You link your preferred subscriptions (like Netflix or Spotify) to the card, and Grow Credit automatically pays them on your behalf, ensuring on-time payments reported to credit bureaus.

- Secured Card: Grow Credit functions as a secured credit card. This means you’ll need to deposit a security deposit that determines your credit limit. As you make timely payments, this deposit builds your credit score.

- Membership Plans: Grow Credit offers various membership plans with different features. The free tier allows linking one subscription with a limited spending limit, while paid plans unlock additional features like higher spending limits, multiple subscription linking, and credit monitoring.

How Does Grow Credit Work?

Here’s a breakdown of the Grow Credit process:

- Choose a Membership Plan: Select a plan that best suits your needs, considering the number of subscriptions you want to link and your budget.

- Security Deposit: Make a security deposit that becomes your credit limit.

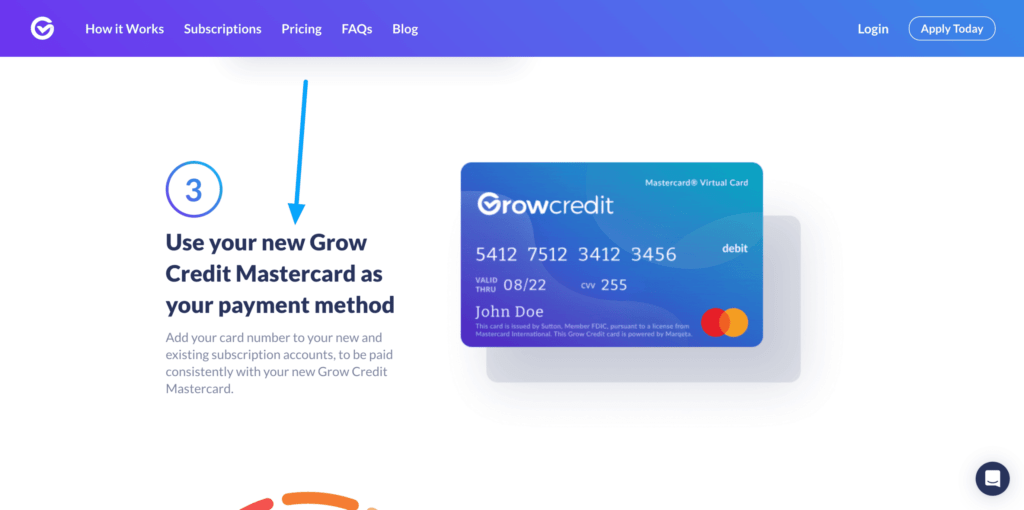

- Link Subscriptions: Connect your chosen subscriptions to the Grow Credit Mastercard.

- Automatic Payments: Grow Credit automatically pays your linked subscriptions on your due date, ensuring timely payments reported to credit bureaus.

- Credit Building: As you consistently make on-time payments, your credit score is likely to improve.

Building Credit Score with Polosploits

Struggling with a limited credit history or a less-than-ideal credit score can feel like a roadblock to achieving your financial goals. This is where Polosploits comes in, offering a helping hand to navigate the often-complex world of credit building.

Polosploits is a service designed to empower individuals to take control of their creditworthiness. Through their tailored programs and resources, they aim to demystify the credit-building process and equip users with the knowledge and tools needed to establish or improve their credit score. Whether you’re just starting out on your credit journey or looking to rebuild past missteps, Polosploits can be a valuable partner in unlocking a brighter financial future.

Grow Credit App Reviews: A User’s Perspective

While the concept of Grow Credit sounds promising, it’s important to consider user experiences before diving in. Here’s a look at what Grow Credit app users have to say:

The Positives:

- Effortless Credit Building: Many users appreciate the ease of use. Linking subscriptions and automatic payments simplify the credit building process, making it ideal for those who struggle with managing multiple cards or remembering due dates.

- Credit Score Improvement: Several users report a positive impact on their credit scores after using the service consistently. The on-time payment history gets reflected in credit reports, potentially leading to score improvement.

- Helpful Customer Service: Positive reviews acknowledge responsive and helpful customer service that addresses user concerns promptly.

The Not-So-Positives:

- Limited Spending Power: The restricted spending limits, especially with the free tier, can be limiting for users with multiple subscriptions. Upgrading to a paid plan becomes necessary to manage a wider range of subscriptions.

- Security Deposit Concerns: Some users express discomfort with the upfront security deposit, especially if they’re unsure about the program’s long-term effectiveness.

- Cancellation Issues: A few reviews mention encountering difficulties canceling their membership or retrieving their security deposit.

Before You Get Started with Grow Credit:

Here are some points to consider before signing up for the service:

- Credit Building Alternatives: Explore other credit-building options like secured credit cards offered by traditional banks. These may offer higher spending limits and lower fees compared to Grow Credit’s paid plans.

- Understanding Membership Costs: Carefully evaluate the membership fees associated with paid plans and make sure they fit your budget.

- Focus on Overall Credit Health: While the service simplifies on-time payments, building a strong credit score requires a holistic approach. Address any errors on your credit report and maintain responsible credit utilization across all your credit cards.

Is Grow Credit Right for You?

The service offers a convenient way to build credit, especially for those who struggle with managing multiple cards or remembering due dates. However, the limited spending power and membership fees can be drawbacks.

Carefully weigh the pros and cons, compare Grow Credit with alternative credit-building options, and make sure it aligns with your financial goals and budget before signing up. Remember, consistent on-time payments across all your credit obligations are key to building a healthy credit score in the long run.

By understanding Grow Credit’s functionalities and user experiences, you can make an informed decision about its role in your credit-building journey.

Grow Credit: Beyond the Basics

Having explored the core aspects of Grow Credit, let’s go deeper into some additional considerations:

Building a Strong Credit Profile:

- Credit Utilization: While the service enforces on-time payments, remember credit utilization plays a significant role in your credit score. Aim to keep your overall credit card utilization (including Grow Credit) below 30% for optimal credit health.

- Credit Mix: Grow Credit establishes a credit history with a revolving credit line (credit card). Consider diversifying your credit mix in the future by responsibly using installment loans (like student loans) to demonstrate your ability to manage different credit types.

Long-Term Strategies:

- Graduation Path: While Grow Credit can be a helpful starting point, explore their graduation plan. Ideally, after consistent on-time payments and credit score improvement, you should be able to transition to a traditional credit card with potentially better rewards and benefits.

- Long-Term Fees: Consider the long-term cost-effectiveness of Grow Credit’s membership fees. If you plan to use it for an extended period, calculate the total fees compared to alternative credit building options.

Alternatives to Grow Credit:

- Secured Credit Cards from Traditional Banks: Many banks offer secured credit cards with similar functionalities to Grow Credit. These cards might come with higher spending limits and potentially lower fees, especially if you have a banking relationship with the issuer.

- Credit Builder Loans: Consider credit builder loans where you make fixed monthly payments towards a savings account held by the lender. Upon successful completion of the loan, you receive the saved amount along with a positive credit history reflecting your on-time payments.

Grow Credit presents a user-friendly approach to credit building, particularly for those new to credit or struggling with managing traditional cards. By understanding its functionalities, limitations, and user experiences, you can make an informed decision about its role in your credit-building journey.