With credit playing a major role in our lives, understanding and managing your credit score is essential. Credit Sesame, a popular financial app, promises to help you do just that. But with many credit monitoring services available, is Credit Sesame the right choice for you? This review talks about Credit Sesame’s features, analyzes user experiences, and explores its legitimacy and effectiveness.

Is Credit Sesame Legit?

Absolutely. Credit Sesame is a legitimate company founded in 2010. They boast a strong online presence and operate within legal boundaries. They are not affiliated with the major credit bureaus (Equifax, Experian, and TransUnion) but access your credit report information through a legitimate process.

Here’s what solidifies the company’s legitimacy:

- Publicly Traded: Credit Sesame is a publicly traded company on the NASDAQ stock exchange under the ticker symbol CRDT. This transparency provides accountability and reduces the risk of scams.

- Partnerships: The service partners with reputable institutions like TransUnion for credit monitoring and Visa for their Credit Builder debit card.

Is Credit Sesame Safe?

Credit Sesame prioritizes user data security. They employ industry-standard encryption methods to safeguard your personal information. Here are some security features reassuring users:

- Multi-Factor Authentication: This adds an extra layer of security by requiring a code besides your password when logging in.

- Data Encryption: The company encrypts your sensitive data, making it unreadable in case of a breach.

- Regular Security Audits: They conduct regular security audits to identify and address vulnerabilities.

How Accurate is Credit Sesame?

Credit Sesame provides your credit score and report derived from TransUnion. While not all three bureaus are monitored, the information is generally considered accurate. However, discrepancies can occur. You’re entitled by law to a free credit report from each bureau annually. It’s wise to compare the information Credit Sesame provides with the reports directly from the bureaus to ensure accuracy.

Is Credit Sesame Good?

They offer valuable features, making it a good option for many users. Here’s a breakdown of its pros and cons:

Pros:

- Free Credit Monitoring: The service offers free credit score monitoring and basic credit report information.

- Credit Builder Tools: It provides tools like the Credit Builder debit card to help establish or improve your credit score. (We’ll talk about this feature later)

- Educational Resources: They offer educational materials to enhance your financial literacy and credit management skills.

- Alerts and Notifications: You receive alerts for suspicious activity on your credit report, helping you identify potential fraud.

Cons:

- Limited Free Features: Advanced features like credit monitoring across all three bureaus and identity theft protection require a paid subscription.

- Upselling: They can be aggressive in promoting their paid services.

- Inaccurate Information (Sometimes): As mentioned earlier, discrepancies between Credit Sesame’s report and the official reports from the credit bureaus can occur.

Credit Sesame Score vs. FICO Score

It’s important to understand the difference between the credit score Credit Sesame provides and your actual FICO score. Credit Sesame uses VantageScore 3.0, a credit scoring model. While both VantageScore and FICO scores assess creditworthiness, they use slightly different algorithms, leading to variations.

The FICO score is the most widely used credit score by lenders, so it’s important to be aware of your FICO score when applying for loans or credit cards. You can obtain your free annual credit report directly from each bureau, which will include your FICO score.

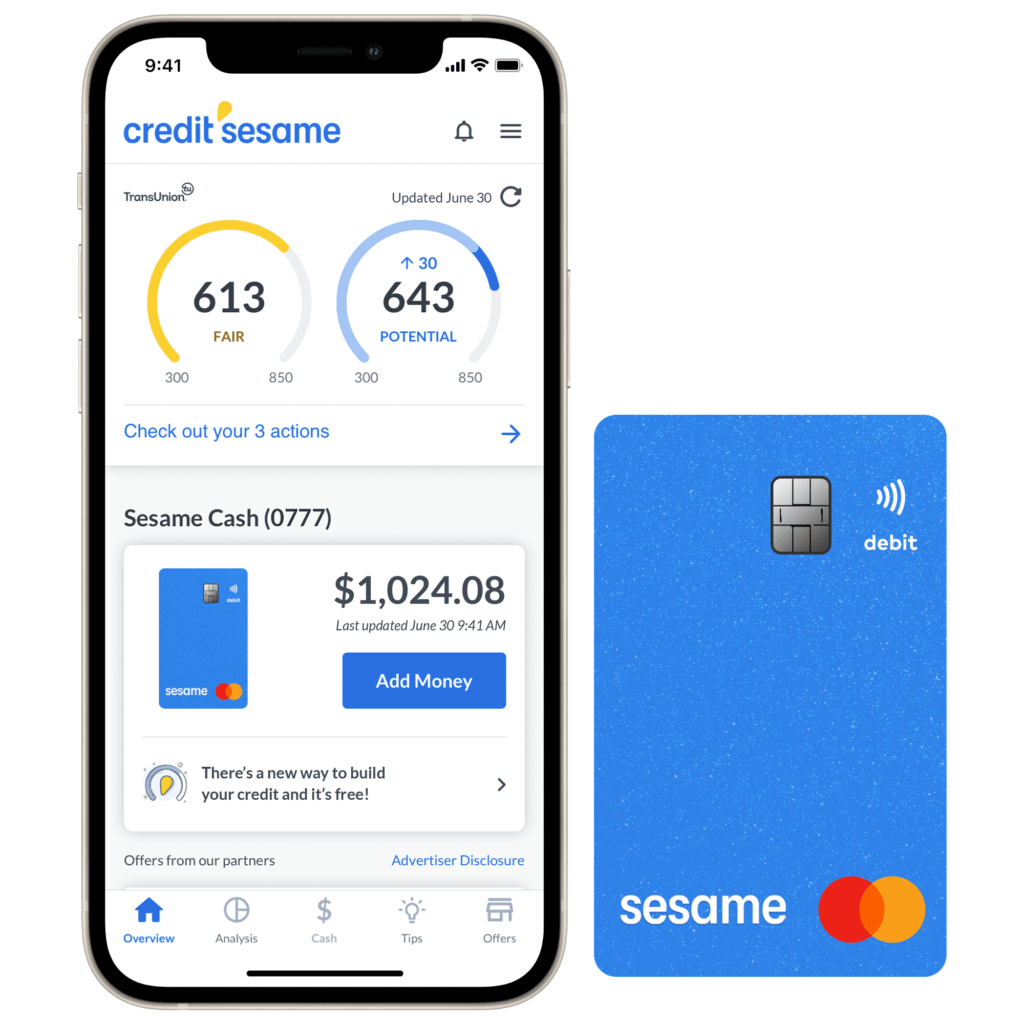

Credit Sesame Credit Builder

The Credit Builder debit card is a unique feature Credit Sesame offers. It functions differently from traditional secured credit cards. Here’s how it works:

- Set Up: You link your checking account to Credit Sesame and establish a security deposit amount (minimum $25).

- Use the Card: You use the debit card for everyday purchases. The security deposit you set becomes your spending limit.

- Build Credit: The service reports your on-time debit card payments to TransUnion, which can positively impact your credit score.

Pros of Credit Sesame Credit Builder:

- No Hard Inquiry: Unlike secured credit cards, using the Credit Builder debit card doesn’t involve a hard inquiry on your credit report, which can slightly lower your score in the short term.

- Flexible Spending Limit: You can adjust your security deposit (spending limit) at any time.

- Potential Rewards: They offer a program where you can earn up to $100 if your credit score improves within 30 days of using the Credit Builder card (subject to terms and conditions).

Cons of Credit Sesame Credit Builder:

- Limited Credit Building Impact: Since it’s a debit card, you’re not actually building credit by borrowing and repaying money. This may limit the positive impact on your score compared to a traditional credit card.

- Fees: There’s a monthly inactivity fee if you don’t use the card for at least one purchase within a certain timeframe.

When Does Credit Sesame Update?

Credit Sesame typically updates your credit score weekly. However, the actual update frequency can vary depending on TransUnion’s reporting schedule. There may be occasional delays.

Alternatives to Credit Sesame

While the service offers valuable features, it’s not the only option. Here are some reputable credit score building services to consider:

- Polosploits: Polosploits provides a comprehensive credit monitoring service that includes all three bureaus and offers credit score simulations to help you understand the impact of different financial actions. They also boast personalized credit improvement recommendations.

- Credit Karma: Credit Karma offers free credit monitoring and basic credit report information. They also provide educational tools and credit card recommendations.

- Free Annual Credit Reports: Don’t forget, you’re entitled to a free credit report from each bureau annually. This allows you to monitor your credit directly from the source.

Is Credit Sesame Right for You?

Credit Sesame can be a valuable tool, especially for those looking for a free way to monitor their credit score and access basic credit report information. The Credit Builder debit card is also an interesting option for those seeking to build credit without a hard inquiry. However, keep in mind the limitations of the free features and potential for inaccurate information compared to all three bureaus.

Here’s a quick guide to help you decide:

- Choose Credit Sesame if: You want a free way to monitor your credit score and access basic credit report information. You’re interested in building credit with a debit card and avoiding a hard inquiry.

- Look elsewhere if: You need comprehensive credit monitoring across all three bureaus. You prefer credit score simulations and personalized improvement recommendations. You prioritize completely free services without the risk of upselling.

Ultimately, the best credit monitoring service depends on your specific needs and budget. Consider your priorities and research different options before making a decision.