Credit cards are a powerful tool. They offer convenience, rewards programs, and purchase protection, but wielded irresponsibly, they can also lead to a mountain of debt. The key lies in striking a balance: using your credit card to build a positive credit history, the foundation for future financial security. This article will guide you through the best practices for building credit with a credit card, including navigating secured cards, a great option for those new to credit.

What is the Best Way to Build Credit with a Credit Card?

There’s no magic formula, but responsible credit card use is the cornerstone of building good credit. Here are the key principles:

- Pay Your Bills on Time, Every Time: This is the golden rule. On-time payments account for a whopping 35% of your FICO® Score, the most widely used credit scoring model in the United States. Late payments can tank your score and stay on your credit report for up to seven years, hindering your ability to secure loans and qualify for favorable interest rates.

- Pay Your Balance in Full (or Almost Full): While some credit card companies offer rewards programs that incentivize carrying a balance, resist the temptation. Interest rates on credit cards are notoriously high, and accruing interest charges negates any reward points you might earn. Aim to pay your statement balance in full each month. If that’s not possible, focus on paying at least the minimum amount due to avoid late fees and damage to your credit score.

- Keep Your Credit Utilization Ratio Low: This ratio refers to the percentage of your credit limit you’re using. Ideally, you want to keep this ratio below 30%. Maxing out your credit cards tells lenders you’re a credit risk, lowering your score. Even if you pay your balance in full each month, a high credit utilization ratio can be seen negatively.

- Don’t Apply for Too Many Cards at Once: Every time you apply for a new credit card, a hard inquiry is placed on your credit report. While a single inquiry has minimal impact, multiple inquiries in a short period can lower your score. Be strategic about applying for new cards; space out your applications and only apply for cards you know you’ll qualify for.

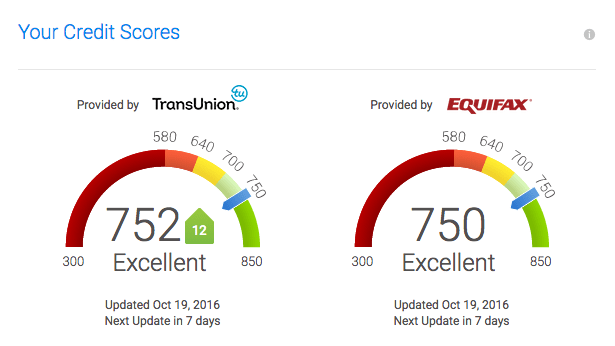

- Monitor Your Credit Report Regularly: It’s important to keep an eye on your credit report for any errors or fraudulent activity. You’re entitled to a free credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) every year. By routinely checking your report, you can address any discrepancies promptly and prevent them from negatively impacting your score.

Following these practices will demonstrate to lenders that you’re a responsible borrower, gradually increasing your credit score and opening doors to better financial opportunities.

Polosploits: Boosting Your Credit Score

While navigating the complexities of credit score improvement can be daunting, you don’t have to go it alone. Polosploits emerges as a valuable tool in your credit score improvement arsenal.

This service offers a comprehensive approach to credit score management. Here’s how Polosploits can empower you:

- Credit Report Analysis: Polosploits can help you obtain your credit reports. Their team can analyze your reports, identifying errors that might be negatively impacting your score. They can guide you through the dispute process to ensure accurate credit reporting.

- Personalized Action Plan: Based on your credit report and financial goals, Polosploits can create a personalized action plan. This plan outlines specific steps you can take to improve your credit score over time.

- Expert Guidance: The Polosploits team offers valuable guidance and support throughout your credit score journey. They can answer your questions, address concerns, and keep you motivated as you work towards your credit score goals.

The journey to a stellar credit score takes time and dedication. Don’t get discouraged by slow progress. Celebrate milestones, stay committed to your plan, and leverage the valuable resources offered by Polosploits.

Best Way to Build Credit with a Secured Card

If you have no credit history or a poor credit score, qualifying for a traditional credit card might be challenging. Secured cards come to the rescue. Here’s how they work:

- Secured Card Basics: A secured card requires a security deposit, typically equal to your credit limit. This deposit serves as collateral for the issuer in case you default on your payments.

- Building Credit with a Secured Card: Secured cards function just like regular credit cards. You use them to make purchases and pay your monthly statements. As long as you manage your credit responsibly, making on-time payments and keeping your utilization ratio low, your positive credit behavior will be reported to credit bureaus, helping you build credit.

- Transitioning to an Unsecured Card: After a period of responsible credit use with your secured card (usually 6 to 12 months), the issuer may offer to convert your card to an unsecured card, returning your security deposit. This unsecured card will typically have a higher credit limit and offer rewards programs.

Secured cards are an excellent first step for those with limited or no credit history. They provide a safe and controlled environment to learn responsible credit card use while building a positive credit score.

Building credit with a credit card is a marathon, not a sprint. By following these steps and practicing responsible credit card use, you’ll be well on your way to achieving a healthy credit score. Make on-time payments a priority, monitor your credit report, and avoid overspending. With discipline and strategic use, your credit card can become a powerful tool for financial empowerment.

Advanced Strategies for Credit Card Optimization

While the core principles outlined above are essential for building credit with a credit card, there are additional strategies you can employ to accelerate the process and maximize the benefits you reap.

- Leverage Rewards Programs: Many credit cards offer rewards programs that incentivize spending. These rewards can come in various forms, including cash back, travel points, airline miles, or points redeemable for merchandise. However, it’s important to choose a rewards program that aligns with your spending habits and avoid falling into the trap of overspending just to earn rewards. Use these programs strategically to offset your everyday purchases, not to rack up unnecessary debt.

- Become an Authorized User: Getting added as an authorized user on someone else’s credit card with a good credit history can positively impact your score. This piggybacks on the positive payment history of the primary cardholder, but proceed with caution. Make sure the primary cardholder is financially responsible and uses their card wisely, as their spending habits will influence your credit score.

- Consider a Credit Builder Loan: This is a unique loan product designed specifically to help build credit. You receive the loan amount in a secured account and make fixed monthly payments over a set term. As long as you make your payments on time, the positive credit history gets reported, boosting your score. Once the loan term is complete, you receive the original loan amount back.

- Maintain a Mix of Credit: While credit cards are a valuable tool for building credit, it’s beneficial to have a mix of credit accounts on your report. Consider including an installment loan, such as a student loan or auto loan (assuming you can manage the payments responsibly). This demonstrates to lenders your ability to handle different types of credit.

Building credit takes time and dedication. Don’t get discouraged if your score doesn’t skyrocket overnight.

Common Pitfalls to Avoid

Building credit requires mindful financial management. Here are some common pitfalls to steer clear of:

- Only Making Minimum Payments: While making minimum payments is better than missing payments altogether, it can take a long time to pay off your balance and accrue significant interest charges. Aim to pay your statement balance in full whenever possible.

- Missing Payments: This is the cardinal sin of credit card use. Even a single missed payment can significantly damage your credit score for years to come. Set up automatic payments or calendar reminders to ensure you never miss a due date.

- Co-signing on Loans for Others: Co-signing on a loan for someone else makes you legally responsible for the debt if they default. This can severely impact your credit score if the loan goes unpaid. Only co-sign for someone you trust implicitly and who has a proven track record of responsible borrowing.

- Closing Unused Credit Cards: While it might seem logical to close unused credit cards, it can actually hurt your credit score. The length of your credit history is a significant factor, and closing older accounts can shorten your average credit age. Consider keeping unused cards open, but make sure they remain inactive to avoid incurring annual fees.