Building credit can feel like climbing a mountain – slow, steady progress with a lot of unknowns. Kikoff emerges as a service offering a helping hand on that climb, but is it a legitimate boost or a clever detour? This Kikoff review dives deep into what the company offers, how it works, and whether it can truly help you build credit.

What is Kikoff?

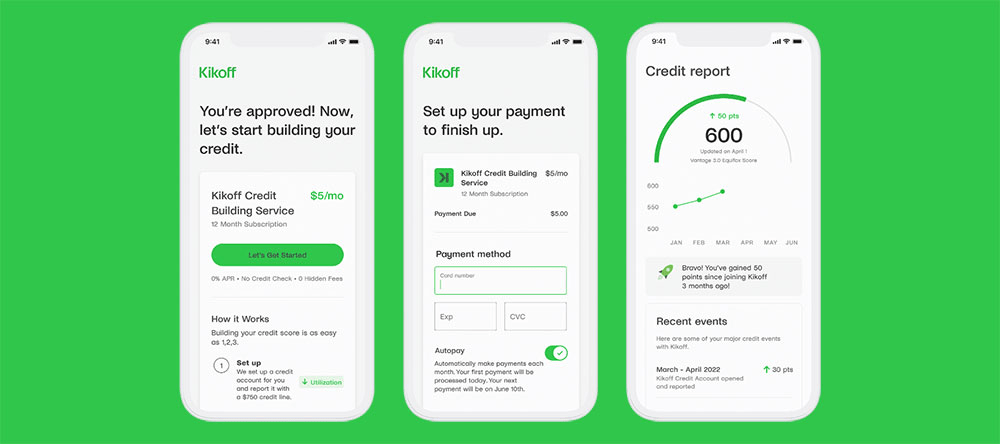

Kikoff positions itself as a credit-building tool designed for those with no or limited credit history. They offer a revolving line of credit of $750 that you can only use on their online store. By making on-time payments on these purchases, Kikoff reports your activity to credit bureaus, which can positively impact your credit score.

Is Kikoff Credit Legit?

Kikoff is a legitimate company in the sense that it’s a registered lender. However, legitimacy doesn’t necessarily translate to being the best fit for everyone. There are pros and cons to consider before signing up.

Does Kikoff Really Work?

Kikoff can help build credit, but there are limitations. Success hinges on using the service responsibly and making on-time payments. Here’s a breakdown of how Kikoff works:

How Does Kikoff Work?

- Sign Up: You can apply for a Kikoff account online. There’s no hard credit check, but you’ll need to provide basic personal information.

- Credit Line & Store Access: Once approved, you receive a $750 credit line. However, you can’t see what items are available for purchase until your account is open.

- Make Purchases: Use your credit line to buy items from Kikoff’s online store. The selection reportedly leans towards educational materials and financial literacy tools.

- Payments: You’ll have a monthly payment due on your credit line balance. On-time payments are reported to credit bureaus, potentially improving your credit score.

Kikoff Credit Builder

While Kikoff positions itself as a credit builder, there are key limitations to consider:

- Limited Buying Power: You can only use your credit line on Kikoff’s store, restricting your purchases significantly. Secured credit cards or credit-builder loans often offer more flexibility.

- Monthly Fee: There’s a $5 monthly fee associated with your credit line, regardless of how much you use it. This can add up over time, especially if you’re building credit on a tight budget.

- Limited Credit Reporting: Kikoff currently reports to two of the three major credit bureaus (Equifax and Experian). This means the impact on your overall credit score may be lessened.

Does Kikoff Give You Money?

No, Kikoff doesn’t directly give you money. It provides a credit line that you use to make purchases within their store. You’re essentially using borrowed money to build credit.

Is Kikoff a Legit Company?

As mentioned earlier, Kikoff is a registered lender. However, reviews paint a mixed picture regarding customer service and account management.

Do You Actually Get Money from Kikoff?

No, you won’t receive any cash from Kikoff. You can only use the credit line to make purchases within their store.

Is Kikoff Right for You?

Kikoff can be a viable option for those with limited credit history who plan to make consistent purchases from their store and prioritize on-time payments. However, the monthly fee and restricted buying power make it a less favorable option compared to secured credit cards or traditional credit-builder loans that offer more flexibility and report to all three credit bureaus.

Before signing up with Kikoff, consider these alternatives:

- Secured Credit Cards: These require a security deposit that acts as your credit limit. Responsible use and on-time payments can improve your credit score.

- Credit-Builder Loans: These function like regular loans, but the borrowed funds are held in a secured account. On-time payments are reported to credit bureaus, helping you build credit.

Polosploits is a reputable service that assists individuals in improving their credit scores. This can be a valuable service, especially for those struggling with financial difficulties or inaccuracies on their credit reports. A higher credit score can lead to several benefits, including:

- Lower interest rates on loans and mortgages: This can save you a significant amount of money over the life of the loan.

- Approval for better credit cards: Cards with higher rewards programs and lower fees can become available.

- Improved rental applications: Landlords often check credit scores when approving tenants.

- Access to better insurance rates: Some insurance companies consider credit scores when setting rates.

By addressing negative items on your credit report, Polosploits can help you achieve these advantages. However, it’s important to remember that legitimate credit repair takes time and effort.

Before using Polosploits’ services, it’s essential to do your research. It’s advisable to understand exactly what services they offer and how much they charge. You should also be aware of your rights under the Fair Credit Reporting Act (FCRA), which allows you to dispute inaccurate information on your credit report directly with the credit bureaus.

Additionally, be careful of companies that make unrealistic promises or pressure you into signing up for their services quickly. A reputable credit repair company will focus on helping you understand your credit report and develop a personalized plan to improve your score.

Ultimately, the best credit-building tool depends on your individual circumstances and financial goals. Carefully research all options before deciding.