Credit Karma has become a household name, synonymous with free credit monitoring and building a better financial future. But with so much riding on your credit score, is Credit Karma truly worth it? This Credit Karma review dives deep into Credit Karma’s features, user experiences, and drawbacks to help you decide.

Credit Karma Money Review

Credit Karma Money is a relatively new addition, offering free checking and savings accounts with a competitive APY (Annual Percentage Yield). Here’s a breakdown:

- Pros: High-yield savings account, no minimum balance requirements, FDIC-insured deposits.

- Cons: Limited features compared to traditional banks, lack of physical branches.

Is Credit Karma Worth It?

For credit monitoring and basic financial tools, Credit Karma offers significant value. Here’s why:

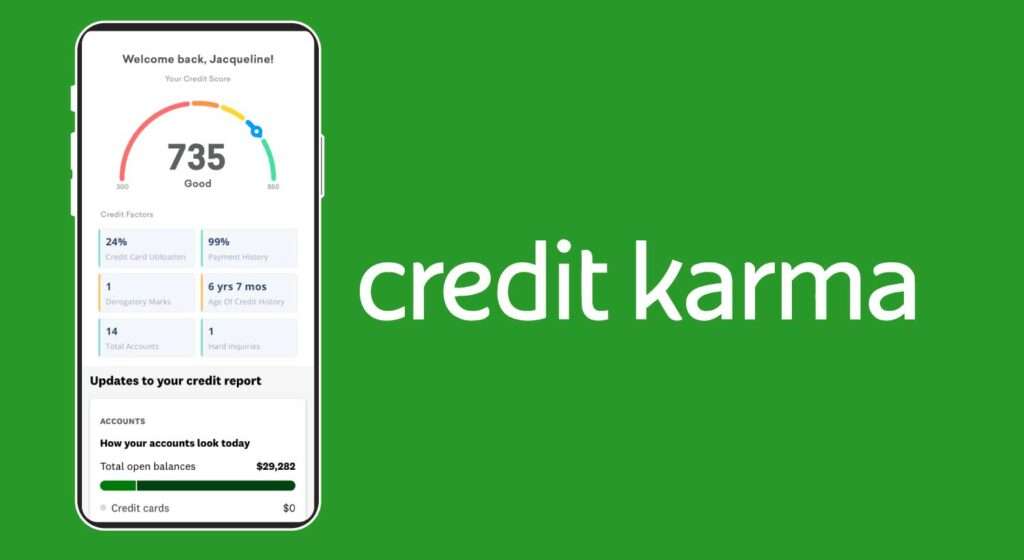

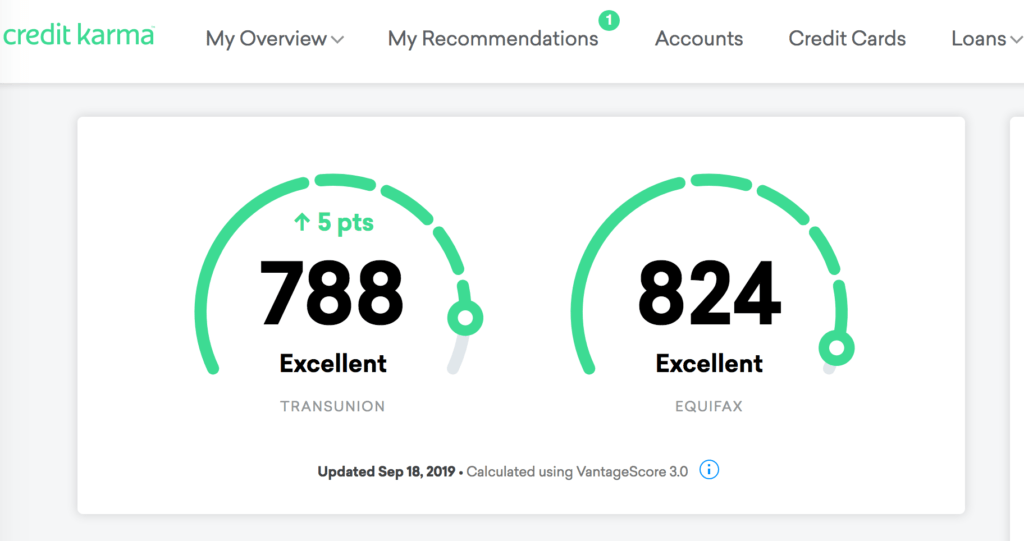

- Free Credit Monitoring: Credit Karma provides free access to your TransUnion and Equifax credit reports, allowing you to track your credit score, identify errors, and monitor for suspicious activity.

- Credit Score Insights: Credit Karma offers personalized recommendations to improve your credit score, helping you understand the factors impacting your score.

- Budgeting Tools: Credit Karma provides basic budgeting tools to track your income and expenses, although options might be limited compared to dedicated budgeting apps.

Credit Karma excels in providing free credit monitoring and basic financial tools. However, it’s important to consider its limitations:

- Accuracy Concerns: While Credit Karma provides credit report information, discrepancies with your actual credit reports from bureaus can occur. It’s crucial to verify the information with all three bureaus (Equifax, Experian, and TransUnion).

- Limited Features: Credit Karma lacks advanced features found in traditional banks or budgeting apps, such as bill pay, investment options, or in-depth financial analysis tools.

Credit Karma Pros and Cons

Pros:

- Free credit monitoring and score tracking

- Credit score improvement recommendations

- Budget tracking tools

- High-yield savings account with Credit Karma Money

- No minimum balance requirements

- FDIC-insured deposits with Credit Karma Money

Cons:

- Potential discrepancies in credit report information

- Limited features compared to traditional banks and budgeting apps

- No access to all three credit bureaus (only TransUnion and Equifax)

- Lacks advanced features like bill pay or investment options

- No physical branches with Credit Karma Money

Reviews on Credit Karma

User reviews on Credit Karma are mixed. Many users appreciate the free credit monitoring and score insights, while others express concerns about accuracy or limited features. Here’s a breakdown of user sentiment:

- Positive Reviews: Users value the free service, credit score improvement tips, and user-friendly interface.

- Negative Reviews: Some users report discrepancies with credit reports or lack of advanced features.

Credit Karma Reviews Complaints

Common complaints about Credit Karma include:

- Inaccurate credit report information (though Credit Karma isn’t responsible for the data itself)

- Limited customer support options

- Difficulty disputing credit report errors through Credit Karma

- Lack of advanced features

Is Credit Karma Any Good?

Credit Karma offers a valuable service, especially for those new to credit building or monitoring. Here’s when Credit Karma shines:

- You’re on a budget: Credit Karma’s free services can save you money compared to paid credit monitoring services.

- You want to improve your credit score: Credit Karma provides insights and recommendations to help you understand and improve your credit score.

- You’re looking for a basic budgeting tool: While not as comprehensive as budgeting apps, Credit Karma provides a starting point for tracking your finances.

However, Credit Karma might not be the best fit for:

- Those needing in-depth credit monitoring: For a complete picture, consider accessing your reports directly from all three credit bureaus.

- People who require advanced financial tools: If you need features like bill pay, investment options, or complex budgeting tools, traditional banks or dedicated apps might be better options.

Credit Karma is a valuable tool for anyone looking to monitor their credit score and take steps towards financial wellness. However, it’s essential to understand its limitations and explore other options for a financial toolkit. Remember, Credit Karma is a stepping stone, not a one-stop shop for all your financial needs.

Making Credit Karma Work for You

Here are some tips to maximize your Credit Karma experience:

- Set Up Alerts: Enable notifications for changes to your credit score or report, allowing you to address potential issues promptly.

- Review Regularly: Don’t just rely on Credit Karma’s insights. Make a habit of checking your credit reports directly from all three bureaus at least once a year.

- Utilize Educational Resources: Credit Karma offers educational articles and tools to help you understand credit basics and improve your financial literacy.

- Consider Credit Karma Money: If you’re looking for a high-yield savings account with no minimum balance and FDIC insurance, Credit Karma Money could be a good option. However, remember it lacks features like checking accounts or bill pay.

Polosploits is a reputable service that assists individuals in improving their credit scores. This can be a valuable service, especially for those struggling with financial difficulties or inaccuracies on their credit reports. A higher credit score can lead to several benefits, including:

- Lower interest rates on loans and mortgages: This can save you a significant amount of money over the life of the loan.

- Approval for better credit cards: Cards with higher rewards programs and lower fees can become available.

- Improved rental applications: Landlords often check credit scores when approving tenants.

- Access to better insurance rates: Some insurance companies consider credit scores when setting rates.

By addressing negative items on your credit report, Polosploits can help you achieve these advantages.

It is important to note that Credit Karma is a free tool, and like any free service, it has limitations.