Introduction

In the ever-evolving landscape of online investments, discerning legitimate opportunities from fraudulent schemes can be a daunting task. One such entity that has recently come under scrutiny is CREST CREDITS. With a name that suggests trust and reliability, many potential investors are curious about the authenticity of this platform. In this detailed review, we will delve into the specifics of CREST CREDITS, analyze its legitimacy, and offer guidance for those who may have been scammed.

Broker Details

- Name: CREST CREDITS

- Investment Category: Online Investment Platform

- Regulation Status/License: Unregulated

- Website: crestcredits.info

- Physical Address: 1 Knightsbridge Green, London, UNITED KINGDOM, SW1X 7QA

- Contact: support@crestcredits.info

- Jurisdiction: United Kingdom

Is CREST CREDITS Legit or Scam?

When assessing the legitimacy of an investment platform like CREST CREDITS, several critical factors must be examined.

Regulation Status

CREST CREDITS is an unregulated entity. This means it does not possess any licenses from recognized financial authorities, which is a significant red flag. Legitimate investment platforms are typically regulated by financial bodies such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the United States.

Website Status

The website crestcredits.info is currently active and operational. However, the existence of a live website does not guarantee the platform’s legitimacy.

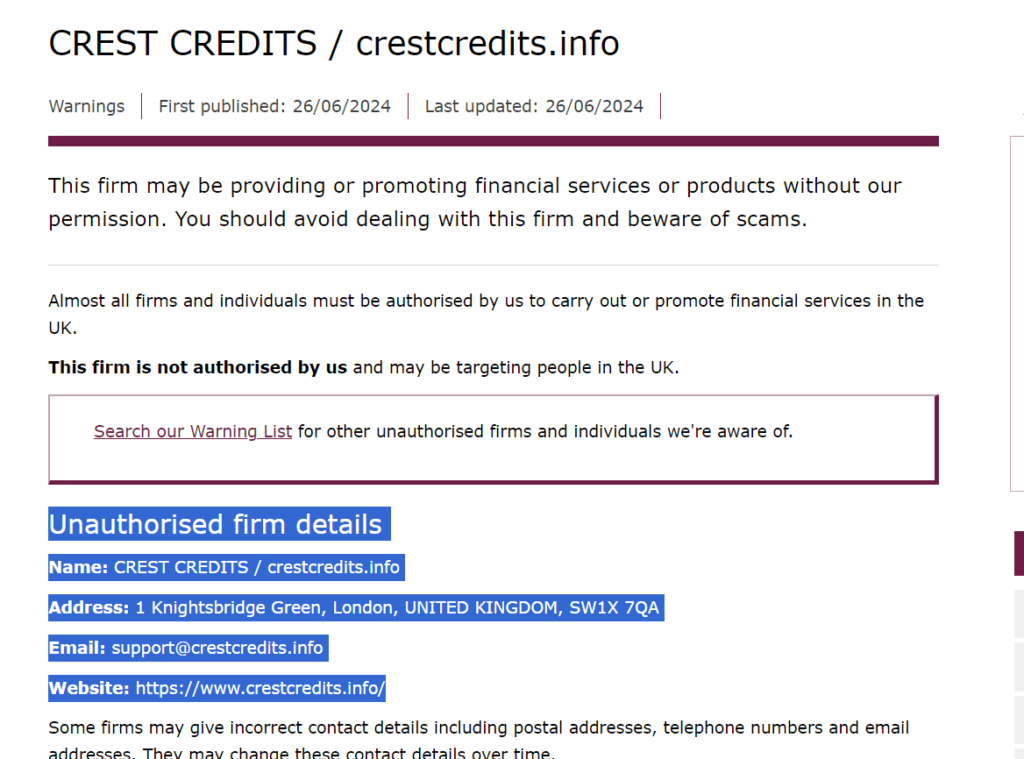

Public Warnings

The FCA has issued a public warning against CREST CREDITS, indicating that this firm is not authorized to operate in the UK. You can view the FCA warning here. Such warnings are serious indicators that the platform may be involved in fraudulent activities.

Red Flags

- Lack of regulation and licensing

- FCA warning against the firm

- No verifiable information about the company’s leadership or team

- Unusually high returns promised to investors

What to Do If You Have Been Scammed Out of Money

If you believe you have been scammed by CREST CREDITS or any other fraudulent investment platform, it is crucial to act swiftly. Here are four steps to take:

- Report the Scam: Notify your local financial regulatory authority. In the UK, you can report to the FCA. In the US, you can report to the SEC.

- Contact Your Bank: Inform your bank or payment provider about the scam. They may be able to reverse the transaction or prevent further unauthorized withdrawals.

- Document Everything: Keep a record of all communications, transactions, and any other relevant information related to the scam. This documentation can be vital for investigations and potential recovery of funds.

- Seek Professional Help: Consider reaching out to a reputable fund recovery service. Be cautious, as there are many fraudulent recovery services as well.

Got Scammed by CREST CREDITS or Other Brokers?

If you have been scammed by CREST CREDITS or any other brokers, know that you are not alone. Many investors have found themselves in similar situations. The journey to recovering lost funds can be challenging, but with the right approach and support, it is possible.

Finding a legitimate and professional funds recovery company is essential. Unfortunately, the market is rife with bogus companies that prey on scam victims, promising to recover funds but ultimately scamming them again. Be wary and conduct thorough research before engaging with any recovery service.

How to Get the Best Lost Funds Recovery Services

One highly recommended fund recovery service is Cronus Tech. Cronus Tech stands out as a reliable and effective recovery and chargeback company. Here are some of the features that make Cronus Tech the best choice:

- Free Consultation: Initial consultation is free, allowing you to understand your options without any financial commitment.

- No Upfront Payments: Cronus Tech does not require any payments upfront, ensuring that you only pay for results.

- Legal Team: Collaborates with law enforcement and legal professionals to enhance the chances of successful recovery.

- High Tech IT Team: Specializes in funds tracing and employs advanced technology to track and recover your money.

- Forensics Team: Utilizes forensic analysis to build strong cases against fraudsters.

- Quick Processing: Efficient and timely processing of cases to ensure swift action.

- High Success Rate: Proven track record of successful fund recoveries and numerous satisfied clients.

For more information, visit Cronus Tech.

Conclusion

Navigating the world of online investments requires vigilance and caution. While the promise of high returns is enticing, it is crucial to thoroughly research and verify the legitimacy of any investment platform. CREST CREDITS, with its lack of regulation and public warnings from the FCA, raises significant red flags.

If you have fallen victim to an investment scam, take immediate action by reporting the scam, contacting your bank, documenting all interactions, and seeking professional help. Remember, recovery is possible, and reputable services like Cronus Tech can provide the support you need.

Empathize with yourself and fellow scam victims. Stay vigilant, and ensure that you only engage with trusted and verified investment platforms and recovery services. For those in need of recovery assistance, contact Cronus Tech for the most trustworthy and efficient service available.