The world of financial services holds immense potential for building a secure future. It offers a variety of investment options and expert guidance to help you grow your wealth. However, lurking beneath this promise lies a threat: financial scams.

These deceptive schemes can be cleverly disguised, preying on unsuspecting individuals and causing significant financial losses. Understanding how these scams work and equipping yourself with the knowledge to identify legitimate financial opportunities is important. Equity Prime has entered the financial world, sparking questions about its legitimacy. This article aims to shed light on the company, its services, and warning signs to consider before working with them.

Equity Prime Details

There are two companies with similar names to consider: Equity Prime Mortgage, LLC, and a lesser-known company called Equity Prime.

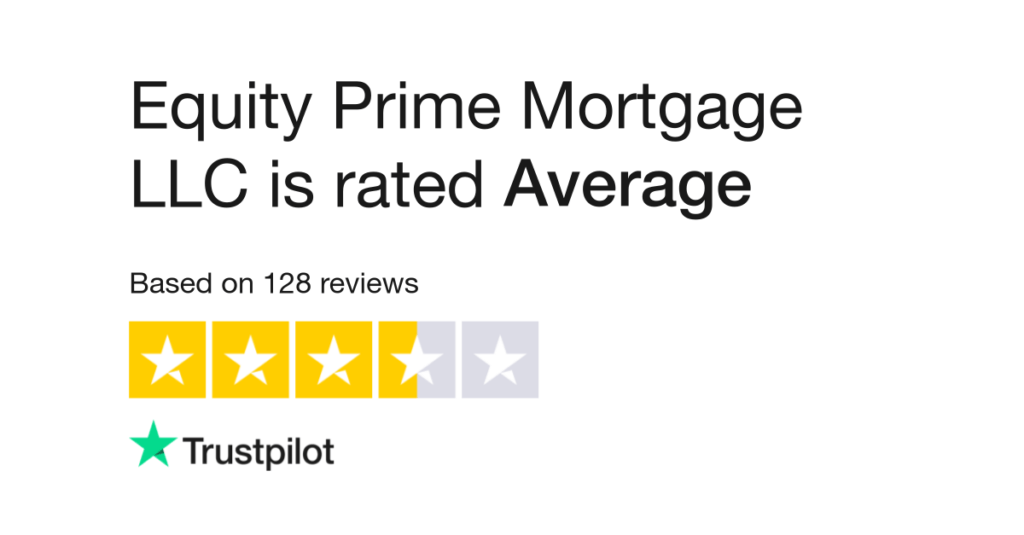

- Equity Prime Mortgage, LLC: This company appears to be a legitimate mortgage lender with a Better Business Bureau (BBB) profile (https://www.bbb.org/us/ga/atlanta/profile/mortgage-banker/equity-prime-mortgage-llc-0443-20002534). They have been accredited with the BBB since 2012 and hold an A+ rating. However, there are customer complaints listed on their BBB profile, so it’s wise to read these before engaging with them.

- Equity Prime (Unverified Company): Information about this company is scarce online. There is no readily available website or clear details about its services. This lack of transparency raises concerns about its legitimacy.

Red Flags (Unverified Equity Prime)

Here are some things to consider in the absence of clear information about the unverified Equity Prime:

- Limited Online Presence: A legitimate financial company should have a well-established online presence, including a user-friendly website and clear information about its services and team.

- Unclear Business Model: Without details about Equity Prime’s services and how they operate, it’s difficult to understand their legitimacy and risks involved.

- Absence of Reviews: Independent user reviews and experiences can offer valuable insights into a company’s reputation. The absence of such reviews regarding Equity Prime is concerning.

Recovering Funds from Financial Scams

We recognize the deep frustration and anger you might feel if a broker scammed you. Losing hard-earned money can be a major setback. Unfortunately, finding a trustworthy company to recover your lost funds can be challenging. Many fake companies prey on scam victims, making unrealistic promises and ultimately adding insult to injury. Be careful and do your research before trusting any recovery service.

While recovering lost funds can be an uphill battle, there are reputable companies that can assist you. Based on our research, Cronus Tech appears to be a reliable option for lost funds recovery and chargebacks. Here’s what sets Cronus Tech apart:

- Free Consultation: They offer a no-obligation consultation to assess your situation and see if they can help.

- Upfront Fee Transparency: You won’t have to pay anything upfront, ensuring there’s no additional financial risk.

- Experienced Legal Team: Cronus Tech boasts a legal team that works with law enforcement, potentially increasing your chances of a successful recovery.

- High-Tech IT Team: Their team specializes in tracing lost funds, employing advanced technology to track down your money.

- Forensic Expertise: A dedicated forensics team analyzes evidence to build a strong case for recovery.

- Quick Processing: They prioritize swift action to maximize your chances of recovering your funds.

- Proven Track Record: Cronus Tech boasts a high success rate and a long list of satisfied clients.

Understanding Mortgage Lenders (Equity Prime Mortgage)

If you’re considering working with Equity Prime Mortgage, here’s some helpful information:

- Mortgage Lenders Explained: Mortgage lenders provide loans to purchase or refinance a property. They typically require borrowers to meet specific creditworthiness criteria and offer different loan products with varying interest rates and terms.

- Researching Mortgage Options: Before choosing a mortgage lender, compare rates and terms offered by different lenders. Consider factors like interest rates, closing costs, and loan types to find the best fit for your needs.

The Importance of Financial Literacy

Understanding basic financial concepts can help you make informed decisions and protect your hard-earned money. Here are some resources that can help you increase your financial literacy:

- Government Resources: Many governments offer resources and educational materials on personal finance. Explore websites and publications from your local financial regulatory bodies or consumer protection agencies.

- Financial Literacy Organizations: Non-profit organizations dedicated to financial literacy can be a great source of information. Look for reputable organizations in your area that offer workshops, seminars, or online resources.

- Financial Blogs and Websites: Several websites and blogs provide high-quality financial information and advice. Look for reputable sources with a track record of providing unbiased and educational content.

If you’re considering working with Equity Prime Mortgage, their BBB accreditation and established online presence offer some reassurance. However, reading customer reviews and comparing rates with other lenders is still necessary.

For the unverified Equity Prime, the lack of transparency raises serious questions about its legitimacy. Due to the limited information available, it’s difficult to recommend them as a trustworthy company.