This article empowers you with knowledge on how to fight back and potentially recover lost funds through a chargeback challenge. Falling victim to a scam can be a devastating experience. Not only is the emotional toll significant, but the financial loss can be a major setback. Whether it’s a fake online store, a phishing email, or an investment opportunity too good to be true, these scams leave countless people feeling violated and unsure of where to turn.

We’ll discuss the impact of scams, explore the chargeback process, and highlight how reputable services like Polosploits.

The Devastating Impact of Scams

Scams come in various forms, but the consequences are often the same: financial hardship, emotional distress, and a sense of vulnerability. Here’s a closer look at the impact of falling victim to a scam:

- Financial Loss: The most immediate consequence is the loss of money. Scammers can steal anything from a few dollars to life savings, leaving victims struggling to cover bills or fulfill financial obligations.

- Emotional Distress: The experience can be emotionally draining. Victims often experience feelings of shame, anger, and frustration, potentially leading to anxiety and even depression.

- Loss of Trust: Being scammed can erode your trust in others, making future financial transactions and online interactions more difficult.

- Credit Score Damage: In some cases, scams can impact your credit score, hindering your ability to secure loans or financing in the future.

These consequences underscore the importance of taking action in the aftermath of a scam. By understanding your options and seeking help where needed, you can reclaim lost funds and begin the process of healing.

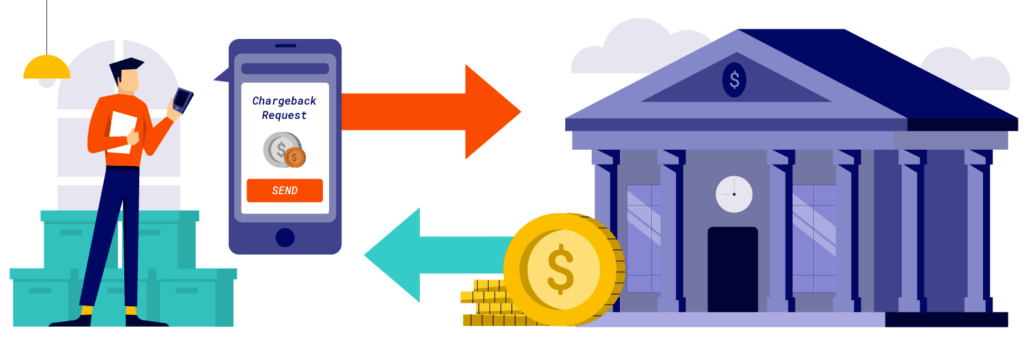

Understanding the Chargeback Process

A chargeback is a formal process initiated by a cardholder (you) to dispute a fraudulent transaction on your credit card or debit card. Here’s a breakdown of the steps involved:

- Contact Your Card Issuer: The first step is to contact your card issuer (bank that issued your card) and report the fraudulent transaction. They will initiate the process on your behalf.

- Gather Evidence: Building a strong case is important. Collect any evidence you have, such as emails with the scammer,screenshots of the fraudulent website, or purchase confirmations.

- Dispute Form: You’ll likely need to fill out a dispute form detailing the transaction and the reason for the chargeback.

- Chargeback Investigation: The card issuer will investigate the claim and contact the merchant in question.

- Possible Chargeback Reversal: If the issuer finds in your favor, the disputed amount will be refunded to your account.

Important Considerations:

- Time Limits: Most card issuers have time limits for filing a chargeback. Act quickly to maximize your chances of a successful claim.

- Eligibility: Chargebacks are not guaranteed. The success rate depends on the specific details of your case and the evidence provided.

- Merchant Response: The merchant has the opportunity to respond to the chargeback claim.

When the Chargeback Gets Challenged

Unfortunately, the merchant can dispute your chargeback. This often happens when the evidence is insufficient or the merchant believes the transaction was legitimate. This is where the process can become complicated and require additional effort.

Financial Forensics: A Valuable Tool

In situations where the initial chargeback is challenged, financial forensics can be a game-changer. Financial forensics involves the investigation of financial transactions using specialized techniques and expertise. Here’s why it’s valuable in the fight against scams:

- Uncovering Hidden Connections: Financial forensic specialists can trace the movement of funds and identify any red flags that may indicate fraudulent activity.

- Strengthening Your Claim: By analyzing complex financial data, specialists can build a robust case for your chargeback, significantly increasing your chances of recovering lost funds.

- Identifying Patterns: Financial forensics can help identify patterns associated with scams, which can be used for future fraud prevention.

How Polosploits Can Help

Polosploits is a leading platform dedicated to helping victims of scams reclaim their stolen funds. Their team of financial professionals leverages their expertise in financial forensics to significantly improve your chances of a successful chargeback challenge. Here’s how they assist you:

- Free Consultation: They offer a free consultation to evaluate your situation and determine the most effective course of action.

- Expert Chargeback Assistance: Their team will guide you through the chargeback process, making sure you file your claim correctly and within the required timeframe.

- Financial Forensics: They will use financial forensics to analyze your case, uncover hidden evidence, and build a solid case for your chargeback.

One comment

My $250,000 investment in a peer-to-peer lending platform turned out to be a fraud. Cronus Tech’s relentless pursuit and sophisticated tracking techniques led to the recovery of $200,000. Their support and expertise were crucial in this difficult time.

Comments are closed.