Good credit is the key that unlocks a world of financial opportunities. From securing a mortgage to qualifying for the best interest rates on loans, a strong credit score can save you money and open doors to a brighter financial future. But how long does it actually take to build good credit? The answer, unfortunately, isn’t a simple one. It depends on several factors, including your credit history (or lack thereof), your current credit habits, and the specific credit score you’re aiming for.

This article will talk about credit timelines, exploring how long it takes to achieve different credit milestones. We’ll also answer some common questions like:

- How can I get a mortgage with bad credit but good income?

- How can I build a good credit score at 18?

- How long does it take to get a loan with good credit?

- How long should I stay at my job to get a car loan with good credit?

Let’s get started!

How Long to Get Good Credit Score?

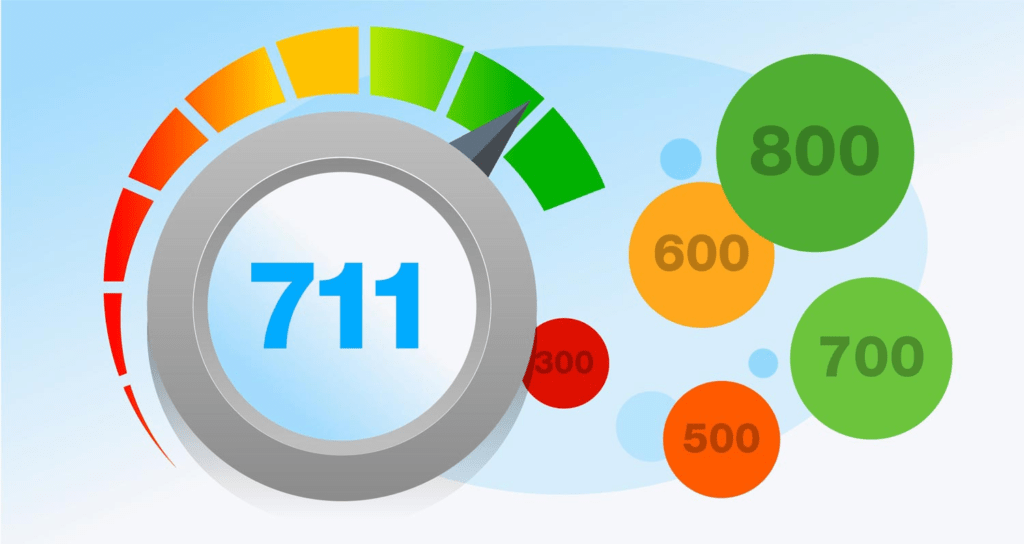

If you’re starting with no credit history, it can take at least six months to generate a credit score. This is because credit bureaus (the companies that track your credit history) need to see a record of your credit activity to calculate your score. However, building “good” credit, which generally refers to a score in the 700-850 range, can take considerably longer. Here’s a breakdown of the timeline you can expect:

- 6 months to 1 year: This is the time frame to establish a basic credit history and score. By consistently making on-time payments and keeping your credit utilization ratio low (the amount of credit you’re using compared to your credit limit), you can build a foundation for a good score.

- 1-3 years: With continued responsible credit management, you can reach a “fair” credit score range (640-699). This can unlock some loan options but may come with less favorable interest rates.

- 3-5+ years: This is where you can achieve the coveted “good” credit score range (700-749). This opens doors to the best interest rates, lower insurance premiums, and easier loan approvals.

- 5+ years: With exceptional credit management and a long credit history, you can reach the “excellent” credit score range (750 and above). This is the ultimate credit score goal, offering the most significant financial benefits.

These are just estimates, and your individual timeline may vary. Factors like negative credit marks (missed payments, collections) can significantly slow down your progress.

Polosploits: Boosting Your Credit Score

While navigating the complexities of credit score improvement can be daunting, you don’t have to go it alone. Polosploits emerges as a valuable tool in your credit score improvement arsenal.

This service offers a comprehensive approach to credit score management. Here’s how Polosploits can empower you:

- Credit Report Analysis: Polosploits can help you obtain your credit reports. Their team can analyze your reports, identifying errors that might be negatively impacting your score. They can guide you through the dispute process to ensure accurate credit reporting.

- Personalized Action Plan: Based on your credit report and financial goals, Polosploits can create a personalized action plan. This plan outlines specific steps you can take to improve your credit score over time.

- Expert Guidance: The Polosploits team offers valuable guidance and support throughout your credit score journey. They can answer your questions, address concerns, and keep you motivated as you work towards your credit score goals.

Shortcuts to Good Credit?

While there’s no magic bullet for building good credit quickly, there are strategies to accelerate the process:

- Become an authorized user: If a trusted family member or friend has a good credit card in good standing, they can add you as an authorized user. Their positive credit history can be reflected on your credit report, giving you a head start.

- Secured credit cards: These cards require a security deposit that acts as your credit limit. Using the card responsibly and making on-time payments helps build your credit history.

- Credit-builder loans: These small loans are designed specifically to help build credit. You make regular payments, and the loan is held in a savings account until the end of the term.

Getting a Mortgage with Bad Credit But Good Income

Even with bad credit, a mortgage might still be possible. Here are some options:

- FHA loans: These government-backed loans are designed for first-time homebuyers and those with lower credit scores (down payment requirements can be as low as 3.5%).

- VA loans: For veterans with qualifying service, VA loans offer no down payment requirements and are often more lenient on credit scores.

- Co-signer: A co-signer with good credit can significantly improve your chances of loan approval.

These options often come with higher interest rates, so weigh the pros and cons before proceeding.

Building Credit at 18

At 18, you can take advantage of your clean slate to build good credit habits:

- Get a student credit card: Many student cards offer rewards programs and are designed for those with limited credit history. Use them responsibly and pay your balance in full each month.

- Become an authorized user: Ask a parent or guardian to add you as an authorized user on their credit card.

How Long Should I Stay at My Job to Get a Car Loan with Good Credit?

Generally, lenders don’t have a minimum employment length requirement for car loans. However, a stable job history demonstrates your ability to repay the loan. Aim to have at least six months to a year of consistent employment before applying for a car loan. This demonstrates financial stability and increases your chances of approval and securing a favorable interest rate.

Getting a Loan with Good Credit: How Long Does It Take?

Once you have good credit, the loan application and approval process can be much faster. Here’s a breakdown:

- Pre-approval: This typically takes 1-2 business days. Getting pre-approved allows you to know your borrowing power and negotiate better rates with lenders.

- Loan application: Completing the application itself usually takes less than an hour. However, gathering necessary documents might add some time.

- Loan approval: This can take anywhere from a few hours to several business days, depending on the lender and loan complexity.

Even with good credit, unexpected factors can delay loan approval. Make sure you have all the required documentation ready and be prepared to answer any questions the lender might have.

Building good credit takes time and dedication. Don’t get discouraged if you don’t see results overnight. By consistently practicing responsible credit habits and utilizing the strategies mentioned above, you can steadily climb the credit ladder and unlock a brighter financial future. Remember, good credit is a valuable asset, and the sooner you start building it, the sooner you’ll reap the rewards.